Today's post comes from my husband, Andy! He writes his own blog on technical stuff and posts often in the blog his company keeps up. Those posts usually don't make much sense to me...but this one does! Read on...

Though many saw it coming, Bank of America's introduction of a $5/month fee for debit card usage has caused much outrage. It is likely that more banks will follow suit, so why is this happening and is there anything to do about it?

Banks have always collected fees from debit card use, but they were previously hidden from cardholders. Retailers bore the brunt of them until the Dodd-Frank Wall Street Reform and Consumer Protection Act (whew!) passed in 2010. That Act allows the Federal Reserve to cap the fees retailers pay, and the Fed used that power to implement new rules earlier this year.

Under the new rules, banks with assets greater than $10 billion may only charge 21 cents + 0.05% for any single debit card transaction. On the average debit card transaction of $38, larger banks can collect roughly 24 cents from retailers.

Previously, banks charged somewhere between 1 and 2%. On $38, that is 38-72 cents.

So it's not very difficult to understand why banks are tacking fees onto cardholders to make up the difference. But just because these fees were introduced for a reason, should you pay them? I don't necessarily think so.

While this fee is only equivalent to one Starbucks coffee per month, there are alternatives worth considering that could save hundreds over time. For instance, Laura and I pay no fees for basic banking services by using a combination of a local credit union and online banks.

Local credit unions typically offer similar services to banks, but underneath they are structured differently: credit unions report to the people who have money deposited; alternatively, banks report to shareholders who own stock in the bank. In my experience, credit unions are overall more member-friendly.

For Laura and me, a local credit union serves as a way to keep teller service, which we occasionally need for mundane things like getting quarters for our laundry machines. As long as we keep $50 in a savings account at our current credit union, we stay members and incur no fees. The National Credit Union Administration website lists credit unions by state.

The majority of our finances, though, use online banks. Because online banks do not have to staff numerous brick-and-mortar locations, they are often able to pass these savings along in the form of no-fee accounts and excellent services.

Choosing to do finances online may seem like a scary undertaking, but as I'll explain, it is at least as safe as a brick-and-mortar bank ... and often times, more convenient.

Here are some things to consider when looking at online banks:

- FDIC/NCUA Insurance: As long as the bank is "member FDIC" or "member NCUA," deposits are insured just like any brick-and-mortar bank. If the online bank were to fail, deposits up to $250,000 are guaranteed by the US government.

- Fees: Many online banks offer totally free checking and savings accounts--including debit card usage--but do dig a bit deeper and make sure there are no minimum balances or direct deposit requirements. All the online banks I recommend below have no hidden fees. Finally, compare any fees for ordering checks or debit cards.

- Withdrawing: How is money withdrawn from an online bank? Many have agreements with large ATM networks to allow free withdrawals at those ATMs. Others simply rebate any fees incurred by using another bank's ATMs. Finally, extra cash can be acquired by asking for cash back when making a purchase. Definitely check on these options before signing up; it may be that there are more convenient locations for accessing money than many brick-and-mortar banks.

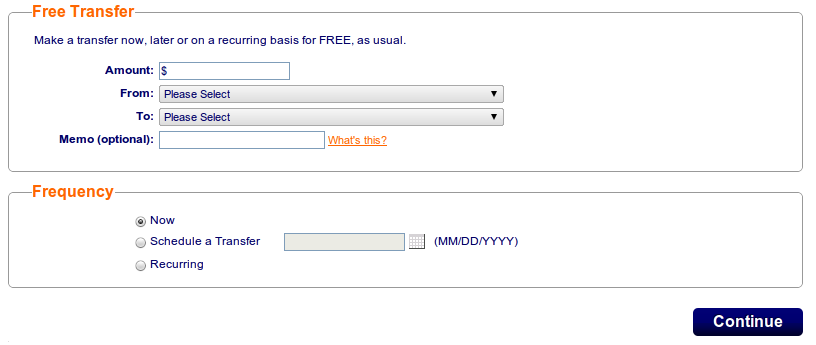

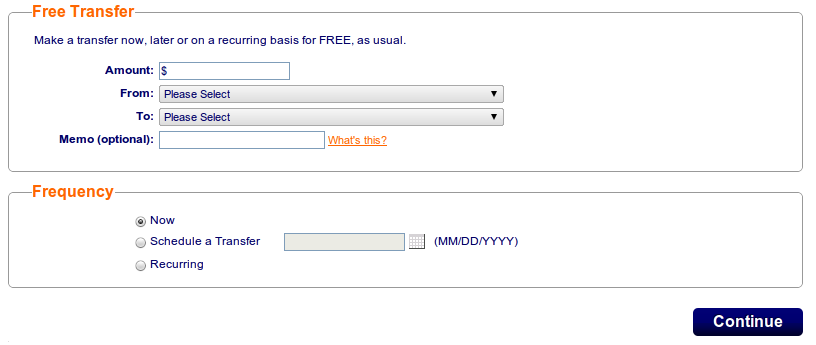

- Transferring: Many online banks offer an interface to transfer money among accounts, including accounts at different banks. It is important to verify that this service is offered and is easy to use, in case money needs to be moved to or from a local credit union or bank. For example, ING Direct's interface is really straightforward:

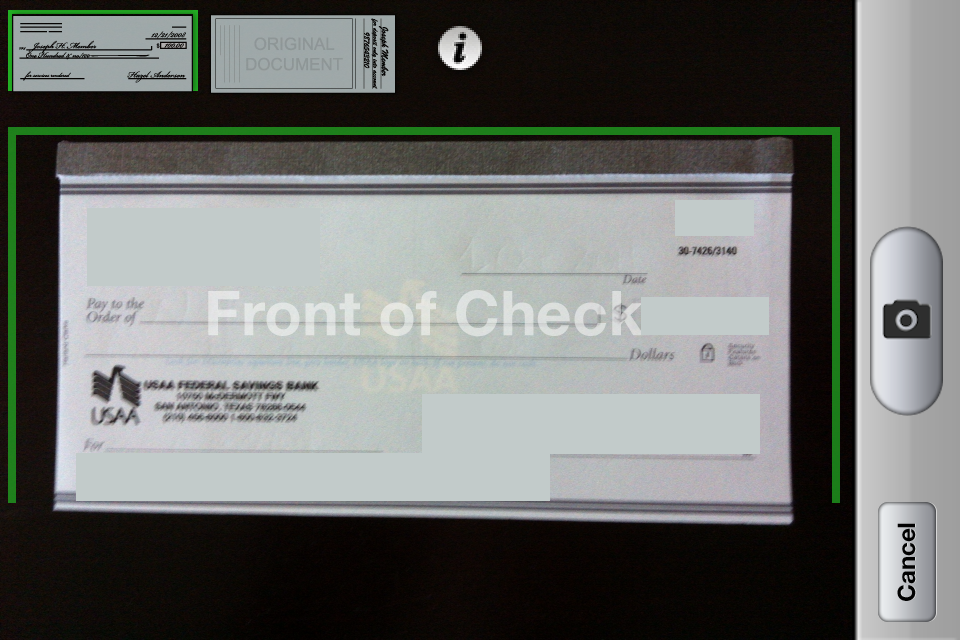

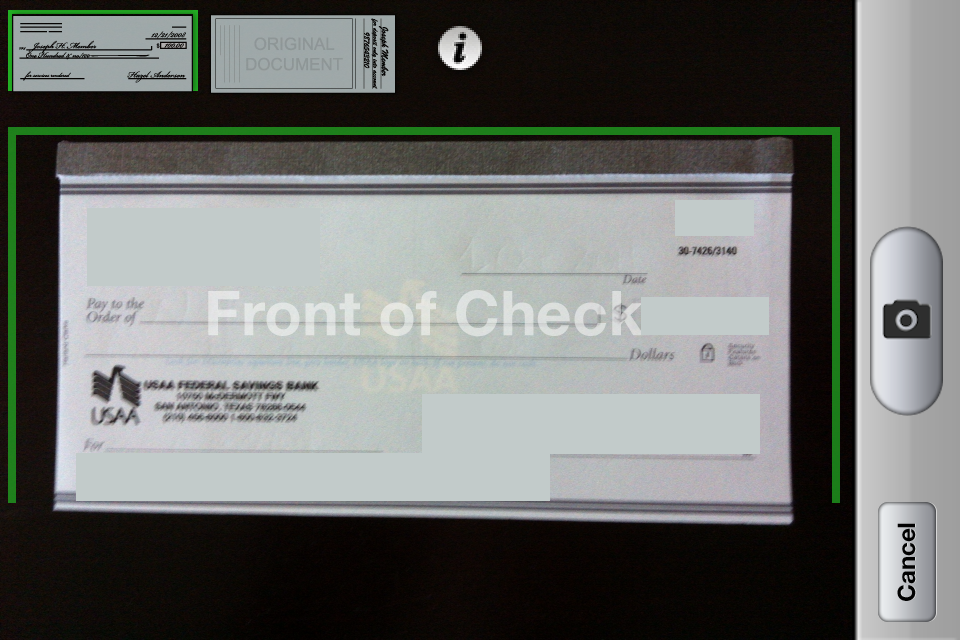

- Depositing: All online banks will allow direct deposit of paychecks. However, what about cash or checks? It is safest to deposit cash at a local credit union or bank and transfer it (see above). Checks can be deposited and transferred in the same way, though some technologically advanced online banks are allowing deposits via mobile phone (for example, USAA's iPhone application depositing a check is shown below). I expect more online banks to offer this option soon (ING Direct, for one, is strongly hinting about offering it).

- Online Bill Pay: Unfortunately some bills must still be paid via physical check. For those bills, many banks offer an online interface for sending these paper payments. The bank stores the details of the bill (address, account number, etc...), so by simply logging into a web interface and entering the amount of the bill, the bank cuts a check and sends it for free (including postage!). All the online banks I recommend below offer this service for free, and I definitely recommend using it.

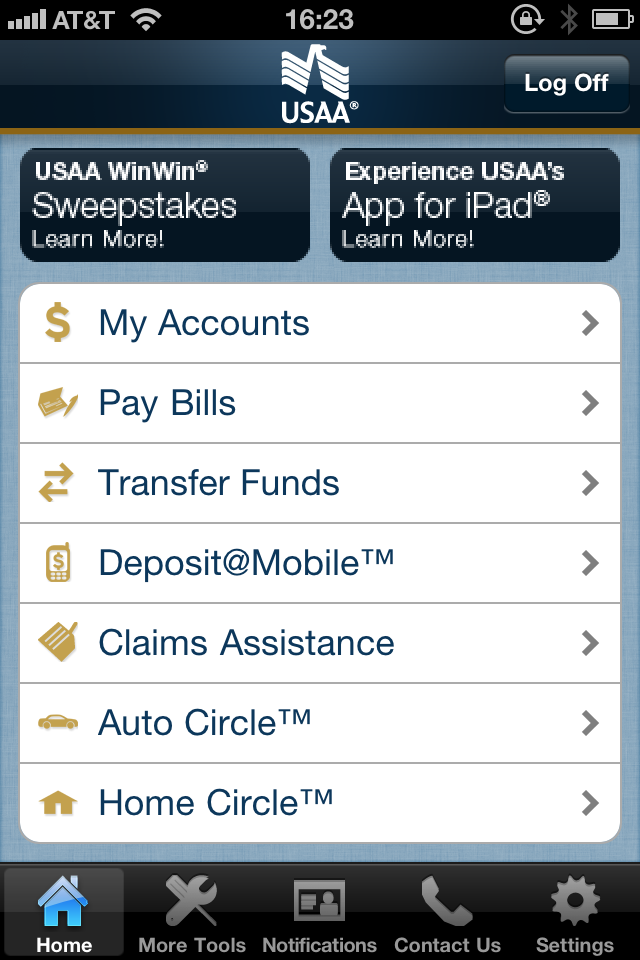

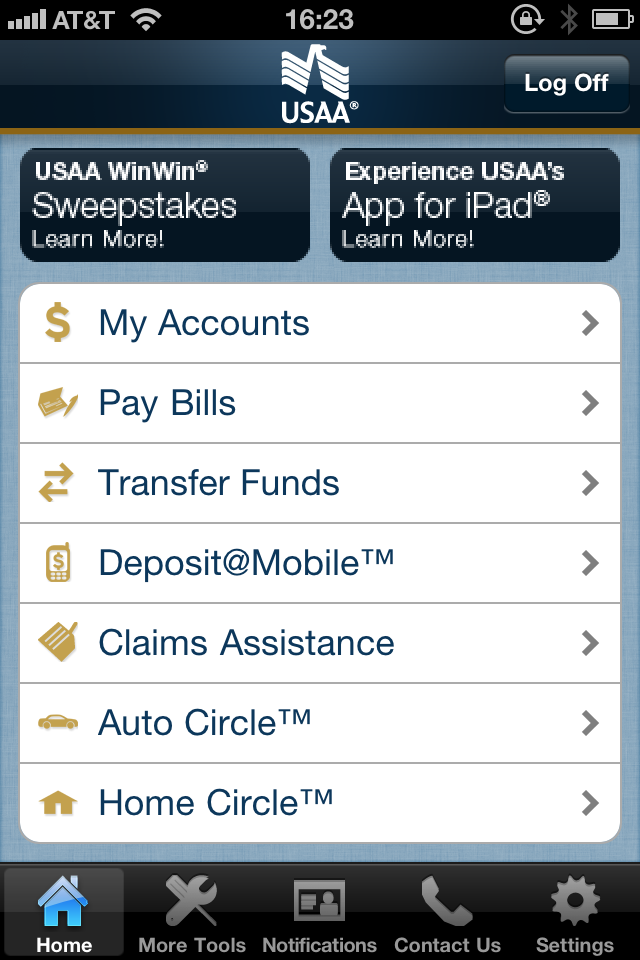

- Mobile Banking: Savvy folks are using smart phones to do more and more these days, and banking is no exception. Online banks typically have a strong mobile app presence, allowing users to check balances, pay bills, and make transfers. For instance, USAA's iPhone app is one of the best:

Now, for the recommendations. All these banks offer free checking and savings accounts--including debit card--and have strong features in my list of guidelines above. If you know of others, feel free to leave comments.

Do you bank online, or would you consider it more strongly now as more and more physical banks are beginning to charge fees? Even I (Laura), often the last to be convinced of adopting a modern technology (i.e. e-books...gasp!) am all about the online banks. I'm finally convinced there's nothing to be scared of....and as Andy just explained, there's probably much to like!